With so many stocks and ETFs listed, it can be overwhelming. That’s where stock screeners come in. They cut through the noise and bring you a shortlist of stocks that fit your exact strategy. In this guide, we’ll break down 4 of the best free stock screeners on the market, each with unique strengths to help you filter, analyze, and discover your next winning trade. Whether you’re a beginner looking for simplicity or an experienced trader chasing technical setups, there’s a free tool here for you.

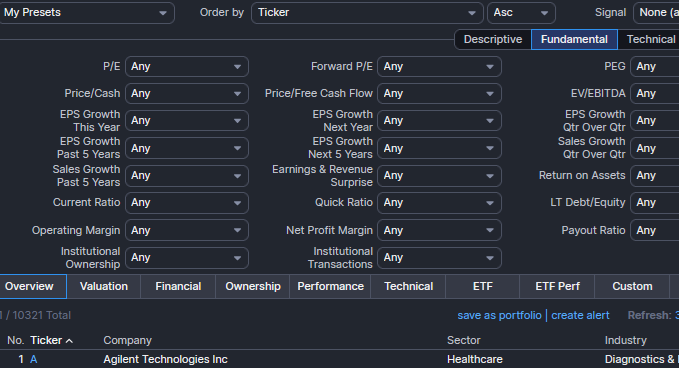

Finviz (https://finviz.com)

Pros:

- Extremely fast and responsive, filters update instantly.

- Huge range of criteria (fundamental, technical, descriptive).

- Visual heat maps and chart pattern search.

- Free version offers a lot and is already very powerful.

Cons:

- Delayed quotes (15–20 min) unless you pay for Elite.

- Mobile experience is less smooth than on the desktop.

- No built-in backtesting in the free version.

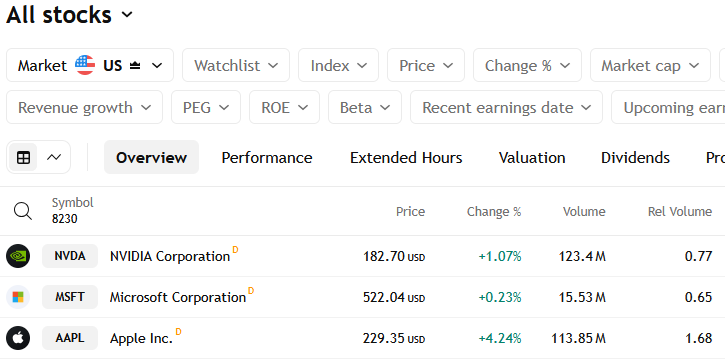

TradingView (https://www.tradingview.com)

Pros:

- Uses top-tier charting tools.

- Real-time data for many markets across the globe.

- Highly customizable filters and market alerts.

- Covers stocks, forex, crypto, and futures.

Cons:

- Interface can be overwhelming for beginners due to the amount of information.

- Some of the more advanced real-time filters require a paid plan.

- The free tier has limits on how many screeners and alerts you can set.

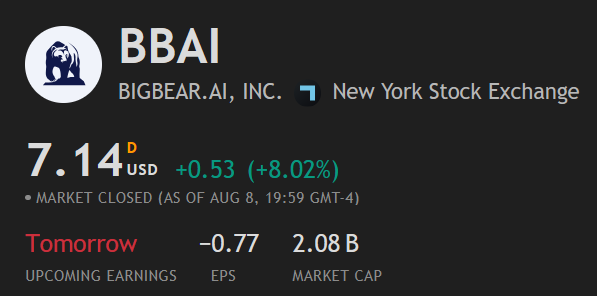

Yahoo Finance Screener (https://finance.yahoo.com/research-hub/screener/)

Pros:

- Very beginner-friendly, clean interface.

- Easy to use with pre-made screen templates.

- Integrates with watchlists and portfolios.

- Good for quick fundamental snapshots.

Cons:

- Fewer filter options compared to Finviz or TradingView.

- Lacks deep technical screening tools.

- Delayed market data.

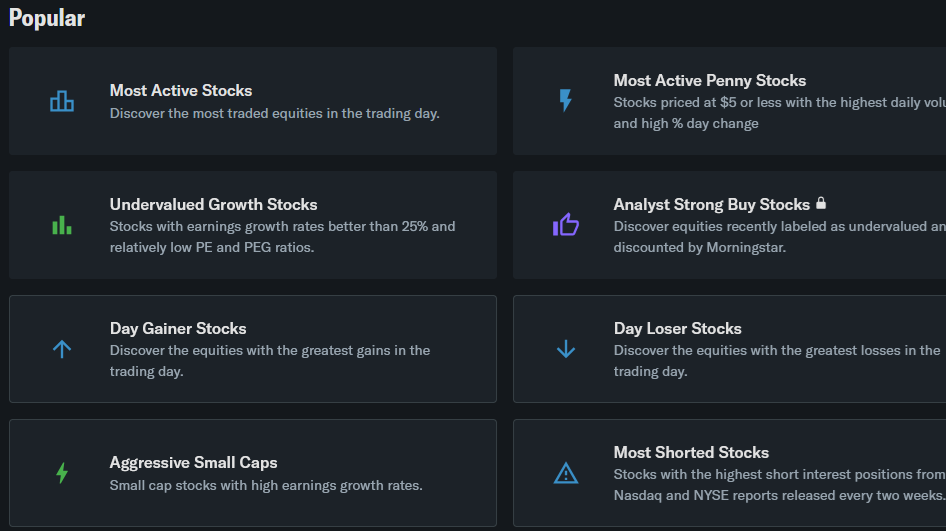

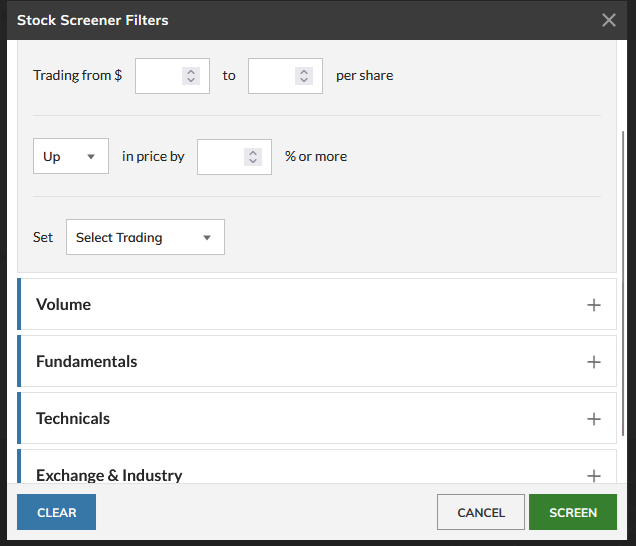

MarketWatch Stock Screener (https://www.marketwatch.com/tools/screener/stock)

Pros:

- Simple, quick stock screening with integrated news.

- Easy access to earnings reports and analyst estimates.

- Good for investors who like news-driven research.

Cons:

- Basic filtering — fewer options than Finviz or TradingView.